When I evaluate the effectiveness of legislation, I first look to see if it will accomplish its objective. Whether I like the objective or not is a separate issue. The name of the legislation is telling and provides a clue to the objective. The Patient Protection and Affordable Care Act.

Health Insurance and Patient Protection

Who are we protecting the patient from? According to the authors of the legislation, the patients were intended to be protected from the big bad insurance companies. What is it that the big bad insurance companies did that needed 2,400 pages of legislation to protect patients from? There are two major complaints by the authors of the legislation:

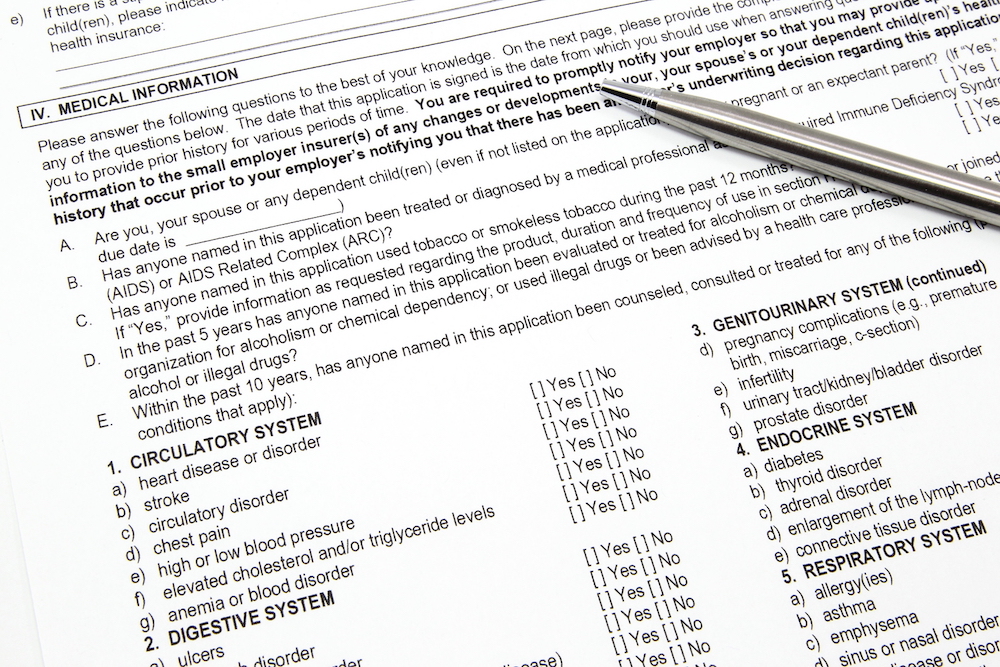

- The insurance companies imposed an underwriting technique on individual policies, not group policies sold to employers, called pre-existing condition limitations. The ACA removed this underwriting practice which increased the price of insurance. If someone is going to purchase individual insurance to protect them from a future financial loss, then that person would not be covered for certain previously existing medical issues. Much like if you purchased car insurance, they also impose pre-existing conditions. You can’t get in a wreck prior to purchasing insurance, and then ask the automobile insurance company to cover your car that was involved in an accident six months ago. Otherwise, everyone would wait to purchase car insurance only once they got into an accident and not before. It should be obvious to everyone why eliminating pre-existing condition limitations would not work on individual coverage; unless one wants to pay extremely high rates. Which is where we are now!

- Per the democrats that designed the ACA, they felt the insurance companies charged too much for too little coverage and made too much money in the process. Their solution in the ACA was to mandate a robust insurance plan, the four-minimal essential coverage metal plans, that covered nearly everything. This forced the people in the marketplace to abandon the purchase of what was characterized as low-end insurance policies. And the democrats limited the amount of money an insurance company not only made in profit, but they also limited the amount it could spend on administrative expenses. This is an unprecedented mandate to limit both the profit a company can make as well as how much it can spend on administrative activities. Whether or not you like an insurance company is not the issue here. This tactic of forcing a company to limit what they can spend on administrative costs should frighten everyone. Your business could be next! And as it turns out, insurance companies over the last 10 years have only made between 3 percent to 5 percent net profit on average. Thus, if the insurance companies are attempting to charge more to consumers in order to gouge them financially to make huge profits, they are doing a poor job at it making only 3 percent to 5 percent.

When the federal government takes on the role of “we know best,” seldom does it turn out well for the recipients of their “wisdom.” Healthcare premiums have increased, making the ACA anything but affordable, and if one cannot afford such a robust mandated insurance product, with extremely high deductibles, then the patient is not protected financially.

Therefore, half of the country would like to see this piece of legislation scrapped. The remaining half are either receiving a premium subsidy or obtaining a real benefit by obtaining insurance for a pre-existing condition that otherwise would have cost that individual dearly. There are those that like the “idea” of “free” healthcare and think somehow that the ACA will evolve into such. Regardless how one “feels,” Trump has made a campaign promise to repeal and replace the ACA.

“To put it simply, this is a classic “power grab” by the federal government to centralize power over 20 percent of our economy”

What will the replacement look like and will the replacement reduce the costs of healthcare? One of Trump’s idea is to allow insurance companies to compete across state lines in an attempt to make insurance more competitive. A lot of individuals that hear such an idea claim that competition will reduce costs and make things better. In a general rule, I would agree. However, this is an idea I strictly oppose for health insurance. Let me explain!

First, health insurance companies already operate in multiple states to the extent they want to operate in multiple states. Take United Healthcare as an example; they operate in all states in one or more of their product offerings. They contract with over a million physicians and 6,000 hospitals. How would “federalizing” healthcare insurance companies make them more competitive? It would not!

First, health insurance companies already operate in multiple states to the extent they want to operate in multiple states. Take United Healthcare as an example; they operate in all states in one or more of their product offerings. They contract with over a million physicians and 6,000 hospitals. How would “federalizing” healthcare insurance companies make them more competitive? It would not!

And my objection is the proper role of the federal government. The U.S. Constitution specifically created the federal government to be limited and small. Every time legislation attempts to transfer a part of commerce regulated by each individual state to the federal government, we diminish the “States Rights” as guaranteed in the Bill of Rights in the 10th amendment. Furthermore, I have seldom seen the benefit of one size fits all people, and mandating that all states have a certain benefit design will certainly increase the cost and limit the 50 incubators of innovation toward product design. To put it simply, this is a classic “power grab” by the federal government to centralize power over 20 percent of our economy, and since Congress has a dismal approval rating of less than 20 percent, why would we hand over more power to an institution we already distrust?

Furthermore, I hate to be the bearer of bad news, but healthcare will not be affordable in the future, regardless what the federal or states governments do. I can assure you that healthcare costs will continue to increase year after year. No politician, republican or democrat, will be able to reduce the cost! All is not lost however!

Trump’s other idea is to re-introduce Healthcare Savings Accounts (HSAs). HSAs are not insurance products per se. They help consumers with the out-of-pocket costs they are responsible for. If I were the architect of the HSAs this is what I would do: First, recognize that healthcare will continue to increase so make sure that over time, consumers are adequately prepared financially to manage the increase. How do we accomplish this task?

“Healthcare should not be federalized!”

Right now, the HSAs have limited contribution levels with too many stipulations. I would remove the maximum amount one can put into an HSA. Let’s face it, deductibles are likely to increase as a way of decreasing the rise in healthcare premiums. I would not make it a conditional and tie it to a Qualified High Deductible Health Plan (HDHP). Co-Insurance, co-payments, deductibles, and limited and uncovered services are all components of insurance that is the financial responsibility of the consumer. Thus, consumers will continue to see increases in deductibles and out-of-pocket costs. Unlimited contributions to the HSA, will prepare consumers for the first dollar coverage and limited and excluded items under their insurance. Also, continue to make the contributions tax free, and allow the consumer to lower their gross taxable income by the amount of any and all contributions. Allow employers to also lower their taxable income for any matching contributions into the employee’s HSA. Allow the consumer at 65-years-old to withdraw an amount of money out of the HSA tax free for non-healthcare services. Allow consumers to accumulate an unlimited amount every year with no penalties if they do not spend a penny on healthcare costs. Allow consumers to leave to their beneficiaries, upon death, the amount of the HSA without any estate tax consequences. Allow the HSAs to be portable and attach it to the consumer as it is now; however, also have their employer-sponsored insurance product become portable. The healthcare exchanges already exist, thus it would not be difficult to allow employees to select an insurance product off the exchange of their choosing as opposed to the employer’s selection.

This last suggestion of allowing the health insurance products to be portable and attach to the employee as opposed to the employer is crucial for many reasons. One, over time, the employer will no longer dictate to an employee that they must be with insurance company “xyz” when the employee wants to be on the “abc” plan. Insurance companies will think and act long-term to keep the member healthy. They are likely to pay doctors more money for improved outcomes of the member as opposed to a straight fee-for-service (FFS) model. Doctors should be rewarded for the overall health outcomes of the patient as opposed to a fragmented component. Thus, the incentives would be aligned for the employee, the insurance company, and the doctor to all try to improve the health of the patient since the patient is likely to stay longer on the health plans that perform for the consumer. Right now, it is not uncommon for an employer to change their insurance carrier every three years. Why would the insurance company worry about the long-term health of a member if they will not benefit financially by investing money to improve their health long-term?

Creating a system that has as the objective long-term strategies in improved health, adequate financial savings to manage the increased costs, and aligning the goals and objectives, will go a long way in “protecting” the patient from financial harm when accessing healthcare services.

This is an idea I can support Trump in repealing and replacing the failed ACA. Healthcare services and delivery of such are complicated! Let’s keep the regulation at the state level and allow the federal government to act as a facilitator by expanding access and financial protection and not by creating burdens of thousands of pages of restrictions that produce no to little value in a thriving market place. The healthcare market place will thrive if we allow a pathway for consumers to save money in a responsible manner for their first dollar coverage and quit micro-managing every aspect of healthcare. Healthcare should not be federalized!

Opinions expressed are solely the views of the author.

Recent Comments