Investing in Down Markets – Avid Wealth Partners

By Victor De La Garza – Associate Portfolio Advisor, Avid Wealth Partners with the collaboration of Eric Kala CPWA®, CIMA®, CFP®, AEP®, CLU®, ChFC®, CRPS® – Founder & Wealth Management Advisor, Avid Wealth Partners

Victor De La Garza

Down markets have been the headlines for nearly every news channel in America and abroad. This is sure to have raised some concern for investors, much like yourself. While times like these might prompt you to run to your advisor or cash out until further notice, it is essential to remind yourself that you’re investing for the long run. In down markets, there are a few strategies that could help you take advantage of losses and buy while securities are cheap!

1. Buying the Dip

Buying the dips occurs after a security or stock index has fallen sharply in value. Investors will purchase these newly lower-priced stocks to capitalize on what they hope will be a rebound in prices. However, like all trading strategies, buying the dip does not guarantee a profit. Investments can drop for many reasons, including changes to the underlying value of the financial instrument. Therefore, a far more long-term solution to this is Dollar Cost Averaging.

2. Dollar Cost Averaging

If you have a plan in place and are investing a set amount of money every month, chances are you are already doing this. Dollar cost averaging is buying a fixed dollar amount of an investment on a regular schedule, regardless of the price. Because of the approach, the investor ends up purchasing more shares when prices are low and fewer shares when prices are high.

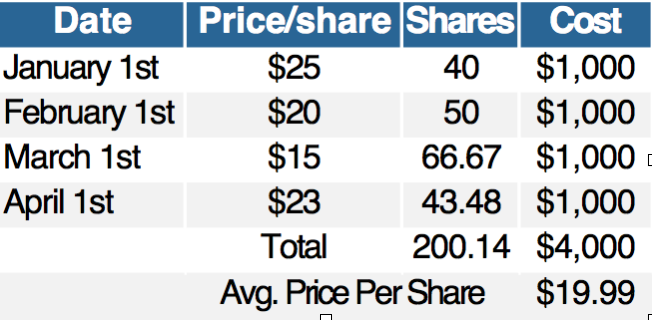

As you can see in the following table, using a dollar cost averaging strategy, the investor would have purchased 200.14 shares for $4,000. Their average price per share for this period would have been just $19.99. With the stock ending at $23 at the end of this period, the investor’s total position would now be worth $4,603.33. As a result, the investor would show a profit of $603.33 on his/her overall position even though the stock declined in value over the full four-month period.

Dollar Share Averaging Chart

3. Tax loss harvesting

If you have investments outside of your Retirement Plans (i.e., Roth IRA’s, IRA’s, 401k’s) in taxable accounts, you may be familiar with the tax you have to pay when selling investments that have appreciated. If you sell an investment at a loss, you could counter any gains you may have realized and offset some of your taxes! There’s a fundamental rule called the Wash-Sale Rule that you must adhere to though:

*You could not have purchased the security, or a substantially identical one, in the last 30 days and/or cannot repurchase in the next 30 days. This rule applies to all accounts you own, including those of your spouse. Consult with a Professional

Consult With A Professional

While many of these strategies seem very simple and easy to execute at first, they can prove to be complicated and very technical. It is always smart to consult a professional that can help you plan and invest for the long term. At AVID Wealth Partners we pride ourselves in the work we do for time-challenged professionals and aim to pursue the future you want avidly.

Eric Kala CFP®, CIMA®, AEP®, CLU®, ChFC®, CRPS®

Avid Wealth Partners Affiliated with Northwestern Mutual

17802 W Interstate 10, Ste. 114, San Antonio, TX 78257

210.446.5718

![]()

Recent Comments